New tech, venture capital feed "gold-rush" among India's IT start-ups

In India's IT

services outsourcing sector, local start-ups, often backed by U.S.

venture capital funds, are nipping at the heels of industry heavyweights

such as Tata Consultancy Services Ltd and Infosys Ltd

These nimble start-ups, most of

them based in Bangalore, offer niche cutting-edge technology products,

solutions and services that traditional outsourcing companies don't

offer, or can't offer at competitive rates.

To be sure, Tata Consultancy (TCS), Infosys and Wipro Ltd

still account for the bulk of the $100 billion-plus core IT industry's

sales and employ hundreds of thousands of engineers. But as these focus

on routine services like application development and IT infrastructure

management, the start-ups are stealing a march in newer areas such as

cloud computing and mobile technology.

The

value of outsourcing contracts for digital technologies - social,

mobility, analytics and cloud (SMAC) - is set to soar to $287 billion by

2016 from $164 billion last year, says Rajat Tandon, a senior director

at the National Association for Software and Services Companies, an

outsourcing sector lobby group.

Start-ups

will lead the race in providing solutions based on these SMAC

technologies, says the group, which predicts the number of start-ups in

India will top 2,000 by 2015, from 450 in 2012.

"There's

a gold rush. Start-ups are rushing in to serve markets that were never

served before," said Sharad Sharma, co-founder of iSPIRT, a think-tank

and start-up consultancy.

HEAD-TO-HEAD

One

such relative newcomer is ISGN, a mortgage technology and services

company backed by California-headquartered New Enterprise Associates and

India's KK Birla group. With a modest workforce of 1,200, the 2007

start-up is already taking business from its bigger, established rivals,

winning outsourcing contracts from leading U.S. mortgage companies.

ISGN

last year won a $75-$100 million renewal order from one of the top five

U.S. mortgage companies which had previously placed work with one of

the major Indian IT firms, said CEO Amit Kothiyal, a former Infosys

veteran. He declined to give details, citing a confidentiality pact.

"We

have a couple of large deals going on right now, where we're competing

head to head with some of the traditional Indian IT majors," he added.

India's

big outsourcing companies have thrived for years by providing IT and

back-office services to global corporations such as Citigroup (

C.N) and BT Group Plc (

BT.L),

tapping a vast cheap local workforce. But they are now coming under

pressure from smaller firms with venture capital funding, a

technological edge and staffed often by skilled engineers who have quit

well paid jobs at the large IT companies to take on the challenge of a

new venture.

"Today, the deal

isn't about labour arbitrage ... to be competitive, companies need to

provide technology, and services become an add-on to that," said Ben

Mathias, a partner at New Enterprise Associates' India unit. "Without

the technology you lose the competitive edge."

U.S. retailer Target (

TGT.N),

for example, is working with five Indian start-ups on areas ranging

from automating the generation of rotating 3D images to the

personalisation of search and product recommendations, said Navneet

Kapoor, its India managing director.

Sudin

Apte, CEO and founder of advisory firm Offshore Insights said the

so-called Global 2000 firms - from the Forbes list of the world's

biggest public companies - are expected to spend 15-16 percent of their

IT services and outsourcing budgets on SMAC, with India forecast to

export $16 billion worth of SMAC software and services in fiscal 2018.

BUSINESS MODEL REVOLUTION

Reuters

spoke to five start-ups, four of which said that more than 60 percent

of their revenues came from clients in the United States and Britain,

and there's almost always an incumbent IT player they have to compete

against.

Client demands range from

quick project turnaround and customised marketing solutions to a need

for a competitive edge in using digitisation, mobile, social media and

other platforms.

The adoption of

digital technology has substantially changed business models across the

financial services, healthcare, entertainment and telecoms industries,

says Sudin Apte, CEO and founder of advisory firm Offshore Insights.

For

example, Mumbai-based Emart Solutions, a loyalty management company,

won a deal with a global energy company by developing new mobile

technology that cut the time needed to process sales data from several

weeks to a few seconds, co-founder Srikanth Chunduri told Reuters.

In

traditional IT services, affordable options like Zoho, which offers

customer relationship management solutions to small and mid-sized firms,

prompted EcoMark, a Denver, Colorado-based solar energy firm, to

migrate from a similar Salesforce.com (

CRM.N)

platform, the start-up told Reuters. Zoho, based in Chennai, said

EcoMark saved more than $1,000 per month for 30 users by switching to

its platform. EcoMark and Salesforce.com did not respond to requests for

comment.

"One can't ignore that

for every account we speak to there's always an incumbent you have to

contend with," said Puneet Jetli, chief operating officer at Happiest

Minds, whose investors include Canaan Partners and Intel Capital. Jetli

says at least 60 percent of the Bangalore-based start-up's new projects

come from companies which are already working with established IT

groups, but want a change.

FUNDING INNOVATION

Venture

capital funding has long been a missing link for budding tech start-ups

in India - from the days when the seven co-founders of Infosys pooled

$250, mostly borrowed from their spouses, to start the company more than

three decades ago.

The country is

now seeing a boom in early-stage investment with a large number of

funds, including U.S.-based Accel Partners, Lightspeed Venture, Charles

River and Sequoia Capital, chasing innovative ideas.

Venture

capital funds invested around $190 million in early-stage tech firms in

India last year, up by almost a quarter from 2012, according to Hong

Kong-based Centre for Asia Private Equity Research Ltd. A total of $623

million has been invested by venture funds in India since 2011,

three-quarters of which was used to buy stakes in software services and

e-commerce start-ups, data from the research house shows.

"India

is undergoing a transformation. The Internet is catching up and is

becoming a basic need here. That makes India an incipient market for

businesses that leverage that," said Prayank Swaroop, Senior Associate

at Accel Partners in India.

The attraction for venture funds was underscored by Facebook Inc's (

FB.O)

acquisition in January of Bangalore-based Little Eye Labs, a start-up

that builds performance analysis and monitoring tools for mobile Android

(

GOOGL.O)

apps. VenturEast Tenet Fund, an early-stage investor in Little Eye

Labs, made a return of multiple times its initial investment, people in

the industry said. Sateesh Andra, managing partner for VenturEast, which

has close to $300 million under management, said returns on Little Eye

were "attractive", but declined to give details.

"There's

a lot of innovation to come and that can only happen if capital is made

available," said Bejul Somaia, India managing director for Lightspeed,

whose investments in India range from $1 million to $25 million. "It's

encouraging to see that more capital is being made available to fund

innovation at a time when these technology platform shifts are underway

and as more young entrepreneurs take the risk of starting companies."

The

established IT companies are taking note, and are open to partnering

with start-ups to reach a wider range of clients, instead of developing

all the facilities themselves.

"We

proactively deliver value using our start-up ecosystem and innovation,

which in turn helps us differentiate from our competitors," said K.R.

Sanjiv, Chief Technology Officer at Wipro.

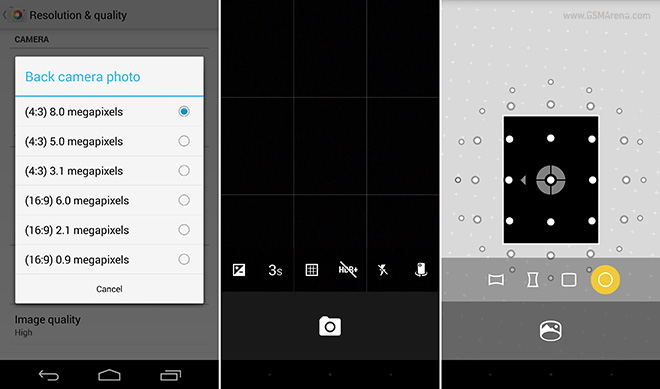

A small example of some Swift source code

A small example of some Swift source code